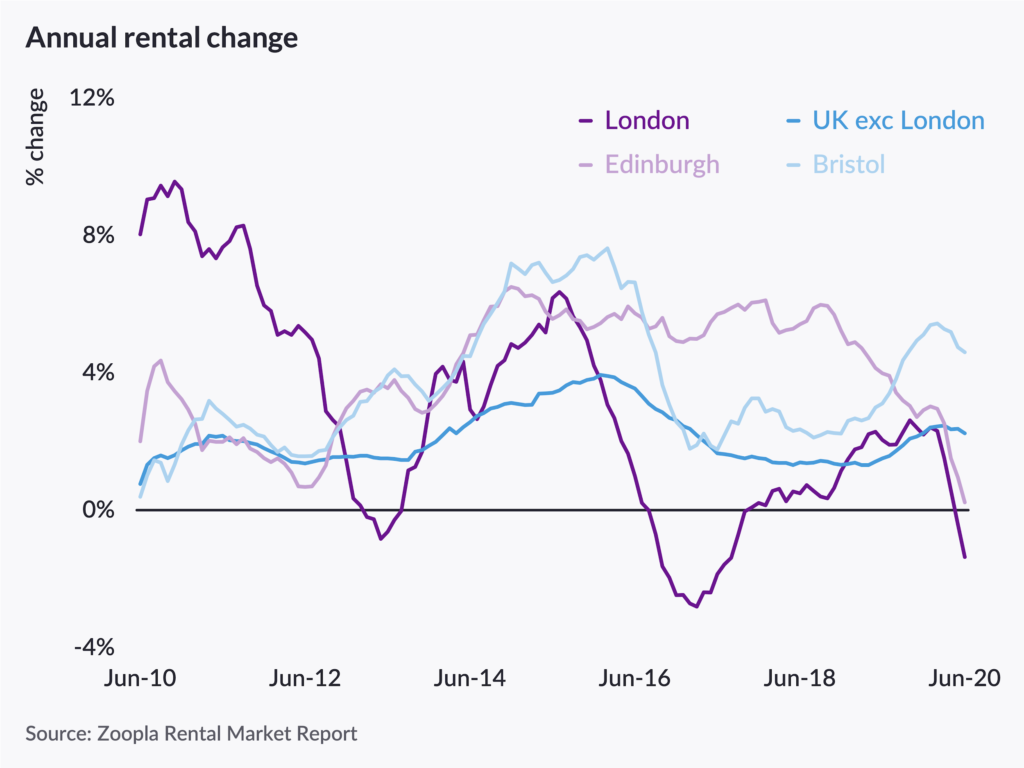

Average rents across the UK dipped by -0.3% in June, and by -0.8% in Q2, taking the annual growth in UK rents to +1.1%, down from +1.7% a year ago. However, a two-speed market has emerged between London and the rest of the UK. These are the latest findings of the quarterly Rental Market Report by Zoopla – the UK’s leading property resource.

Figure 1:

A two speed market

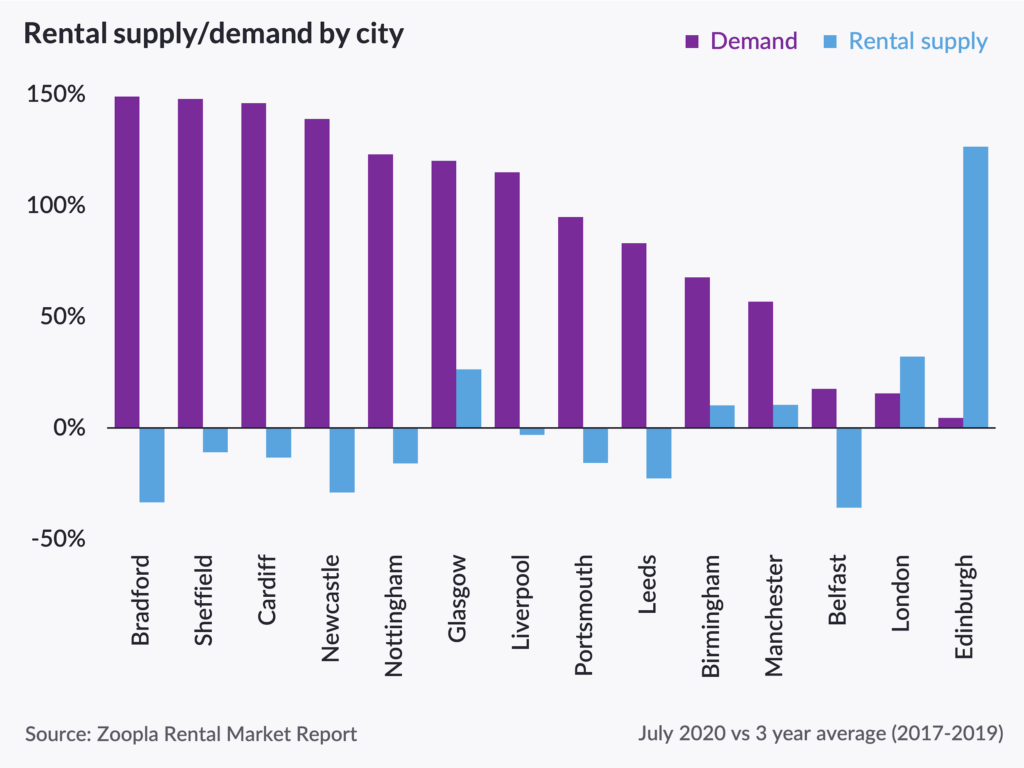

Rental growth in the UK excluding London is up +2.2%, as demand continues to outstrip supply in many markets. By contrast, a different trend is emerging in London, with rising supply and weaker demand – particularly in inner London – resulting in negative rental growth. Edinburgh has also seen a marked slowdown in rental growth to +0.2% over the past year as a result of reduced tourism and policy changes impacting landlords and the supply of property.

Challenging market conditions in London and Edinburgh

The rental markets of London and Edinburgh stand apart from other UK cities in the UK; a rise in supply in these markets, which is increasing choice for renters, is not being matched by similar levels of demand, leading to downward pressure on rents and the rate of rental growth.

Several Covid-related factors have resulted in rising supply in London – in particular in central and inner zones.

The decline in international travel and tourism has seen landlords in the capital, especially in central London, shifting away from short lets, thereby increasing supply in the long let market. Weaker demand means that as tenancies end, they are being absorbed more slowly, compounding the growth in supply.

The rise of homeworking at many firms, with a slow return to offices over the rest of the year, signal that demand for rental property is likely to remain subdued, especially if unemployment starts to rise. Commuting data shows that working patterns in London are still far from returning to levels seen back in March.

Figure 2:

In addition, the student influx expected as part of the usual seasonal busy period in late summer may not be as large this year, as universities migrate towards more online learning.

There is not a one-size fits all picture in London, however. The factors above are most pronounced in central and inner London, where rents are generally higher, and less business travel and business-related rentals with reduced tourism are impacting demand.

Average rents in London have fallen by -3% over 2020 H1 and are down 1.4% on the year. This is the second time rents have fallen into negative territory in the last three years in the capital – rents fell to -2.8% in March 2017 on the back of rising supply after the introduction of the additional 3% stamp duty change in 2016.

In Edinburgh, where annual rental growth has slowed to +0.2%, down from +4% a year ago, the rise in supply has also been exacerbated from the movement into the mainstream rental market by landlords who had been operating their properties as short lets.

The uncertain outlook for international tourism, as well as new legislation that may limit the types of homes that can be used for short lets in the Scottish capital, is likely to have created a one-off shift in properties to mainstream rental.

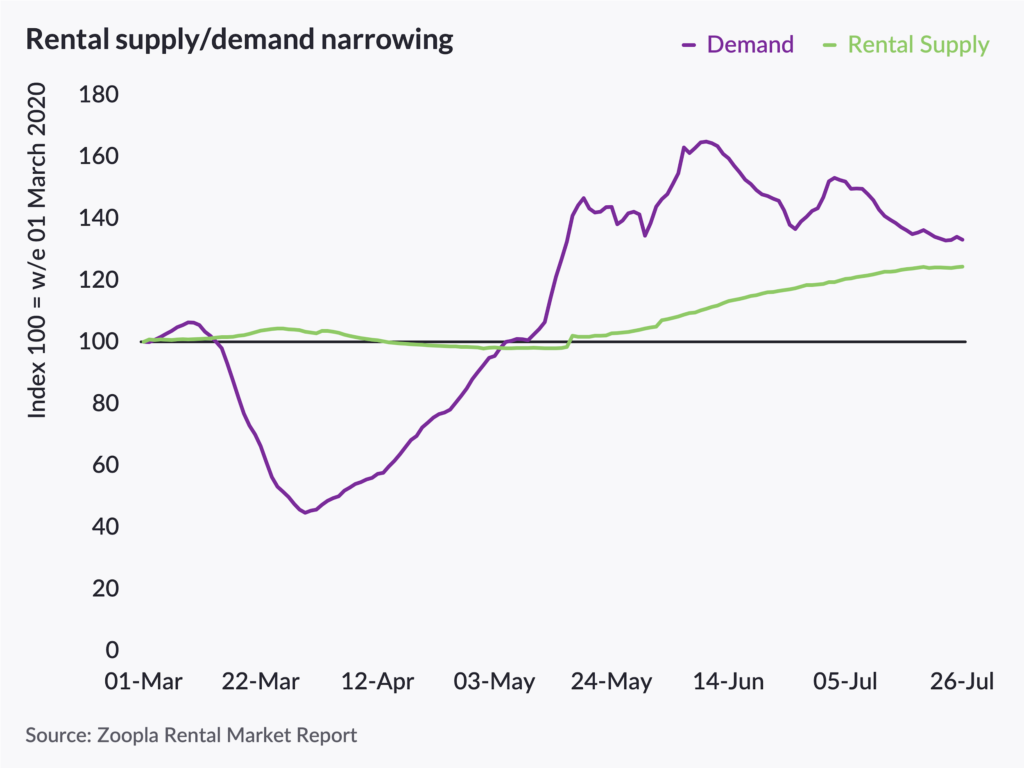

A rebound in demand elsewhere

Rental demand was more resilient during lockdown than demand in the sales market, and although levels are starting to moderate, they are running 33% higher than pre-lockdown, and 25% above 2019 levels across the UK as pent-up demand comes back to the market. Renters, like homeowners, may have used lockdown as a chance to reassess how and where they are living, further boosting rental market activity.

At the same time, the number of homes for rent has increased since lockdown ended – and is slightly ahead of seasonal trends, with the volume of homes for rent nationally up 7% on this time last year.

As this gap between demand and supply continues to narrow through Q3 and Q4, rental growth will start to slow as tenants benefit from a wider array of properties to choose from.

Figure 3:

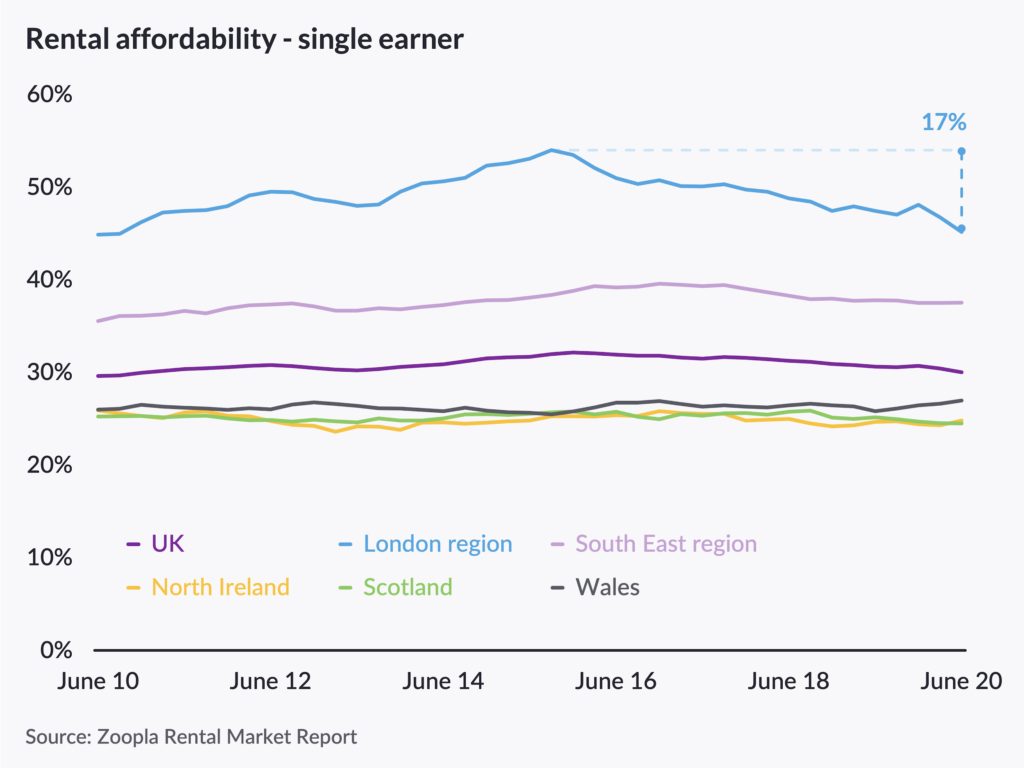

Steady levels of affordability

Levels of affordability within the rental sector have remained largely unchanged in recent years, with the exception of London, where the proportion of income needed to cover average monthly rent has fallen to 45% from 54% in September 2014, although it still remains the most expensive region in the UK in which to rent a home.

Figure 4:

Commenting on the latest Rental Market Report by Zoopla, Gráinne Gilmore, Head of Research, said: “The future path of annual rental growth will be determined largely by the economic outlook, especially the rise in unemployment and the future path of average earnings. However, as new rental supply continues to catch up with demand levels, we could see further softening of headline rental growth by the end of the year, although there will be some areas of outperformance.

“Uncertainty continues over how any further outbreaks of COVID will impact the resumption of office life, student life and tourism, and this uncertainty will impact demand in some markets during the rest of the year.”