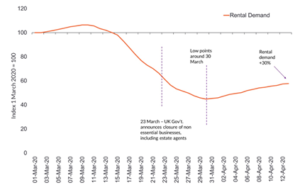

- Impact of coronavirus saw 57 per cent fall in demand for rented housing in the two weeks to 30th March; the fall in demand has since bottomed out and rebounded 30 per cent, off a low base, in the two weeks to 14th April

- Despite signs of life, rental demand is still 42 per cent lower than at the start of March

- The increase in demand has been uniform across the market by region and price

- Rental supply increased ahead of the lockdown as landlords switched from the short to the long let market but the growth in new supply has since slowed

- There has been no mass withdrawal of rented properties listed to let, down just three per cent compared to 1st March

- There are 1.2m moves a year in the lettings market and we expect this to fall 25 per cent over 2020, compared to 2019

- Annual UK rental growth is at 2.4 per cent, up from 1.5 per cent in March last year; rental growth for the rest of the year is expected to moderate but remain in positive territory

Demand for rented properties has bounced back 30 per cent in the two weeks to 14th April, after falling 57 per cent in the wake of coronavirus, according to Zoopla’s latest quarterly Rental Market Report.

Rental market resilience

The impact of Coronavirus has been less pronounced in the lettings market compared to the sales market. The rental market is more dynamic than the sales market and increased uncertainty means households looking for a home will turn to the rental market first to meet any immediate housing need.

Demand for rental properties fell by more than 55 per cent between 7th March and 30th March, while, in contrast, the sales market was hit by a 70 per cent decline in buyer demand, after the government effectively suspended transactions.

The additional flexibility in the lettings market, which has allowed agents to agree rental contracts with delayed start dates, and agree terms based on online viewings, means that activity has continued throughout the lockdown, albeit at a significantly lower rate.

Similarly, activity levels are likely to rise more quickly in the rental market than the sales market once the coronavirus lockdown eases, given that the average ‘time to let’ is less than three weeks in usual market conditions, compared to the three months average to complete a sale. Once lockdown restrictions ease, activity levels will likely rise and match previous years’ levels in the typically busier seasonal periods in Q3 and Q4, meaning that the total number of moves within the rental sector will be approximately 25 per cent lower than in 2019.

The total number of properties listed as available to rent remains broadly unchanged since the start of the lockdown, down three per cent since March 1st, indicating that there has been no large-scale withdrawal of listings.

Figure 1: Weekly change in demand (Indexed 100 = 1st March)

Source: Zoopla Rental Market Report

Source: Zoopla Rental Market Report

Uniform pick up in demand in last two weeks

The growth in demand has been uniform across the market both by region and price bands.

When examining which properties tenants are engaging with online, the data indicates across the country, excluding London, the £500-£600 pcm bracket is the most popular, consistent with trends seen before COVID-19 emerged.

By contrast, London has recorded a marginal shift in demand, with the largest proportion of interest focused on properties with rents of between £1,200 – £1,300 pcm in April, compared to February, when the greatest interest was in properties priced between £1,400 – £1,500 pcm. This could be partly attributed to a change in the financial circumstances of some tenants, but it is premature to conclude whether this trend will persist.

An underlying strength in rents

The Zoopla rental index shows that the annual rate of UK rental growth flattened in March – reflective of seasonal trends rather than ramifications of the coronavirus lockdown. Rents were up 2.4 per cent on the year, compared to 2.5 per cent annual growth in February and the 2.3 per cent recorded in December 2019.

Despite the slight slowdown in growth, rental growth has been on a largely upward trajectory since March 2017 amid increased demand and shrinking supply.

At a city level, the spread of rental growth ranges from 5.9 per cent in Nottingham and -2.1 per cent in Aberdeen. In addition, annual rental growth in London is running at 1.7 per cent, down from 2.3 per cent in the previous quarter, but broadly in line with the same period in 2019 (1.8 per cent). For the first time in 12 months, London’s pace of rental growth has fallen behind the rest of the UK, as stretched rental affordability limits the rate at which rents can grow when compared to the rest of the UK.

Rental growth in London, having risen strongly since March 2017, eased this month, with 1.7 per cent annual growth, down from 2.3 per cent in February. This may partially reflect a slight easing in demand given the post-election bounce in the sales market, and while a lack of supply and slower new investment has supported the uplift in rental growth over the last two years, a sustained delivery of new supply from new build schemes is likely to be adding to availability for renters and keeping rental growth in check.

Gráinne Gilmore, Head of Research, Zoopla says,

“The flexibility of the rental market is one of the key factors which has allowed activity to bounce back more quickly than other parts of the property market. The rise in demand in the first two weeks in April indicates that some tenants are already mapping out their next move.

“As with the whole housing market however, activity levels and rental growth will likely be closely aligned to the economic landscape of the UK once the lockdown eases and the immediate impact of COVID-19 starts to recede.

“Rental growth has increased steadily for the last three years as demand has increased in the face of dwindling new supply. However, If the responses to COVID-19 contribute to a rise in unemployment, as some official bodies have forecast, this will reduce the scope for any additional growth in rents. We expect growth to moderate this year, but to remain in positive territory.”