New research based on the largest survey to date of UK landlords, undertaken for the Council of Mortgage Lenders (CML), reveals significant insights about landlords’ profile, motivations, and plans for the future.

The research, by Kath Scanlon and Christine Whitehead of the London School of Economics, broadly finds that private sector individual landlords – whether landlords with buy-to-let mortgages or other landlords – are adopting an “even keel” mentality.

Around half of all landlords have no mortgage debt at all. But the quarter of buy-to-let landlords with the largest portfolios and highest incomes will be negatively affected by tax changes which may influence their behaviour in ways that it is important to understand. The survey results suggest that targeted measures aimed at buy-to-let landlords may impose significant burdens on them without necessarily resulting in commensurate influence on the behaviour of the private rented sector as a whole.

How many landlords have mortgages?

According to the survey of 2,500 landlords, some 49% of respondents owned all their property outright, with no mortgage debt at all. This was an unexpectedly high figure given that the government 2010 Private Landlords Survey reported that 77% of landlords used a buy-to-let mortgage to acquire their rented property.

But buy-to-let landlords typically hold larger and more valuable portfolios than other landlords, and 47% of the rented properties in the survey were backed by a buy-to-let mortgage.

Among buy-to-let landlords, over half had loan-to-value ratios on their total portfolio of below 60%, with only 1% reporting loan-to-value ratios of over 90%.

How many properties do landlords own?

Some 62% of landlords own only a single rented property, with buy-to-let landlords more likely to have a multi-property portfolio than other landlords. Just over half of buy-to-let landlords own more than one property, with the mean size of a buy-to-let portfolio being 2.7 properties.

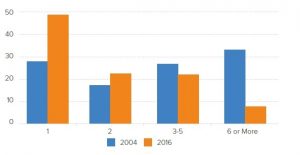

However, there has been a marked shift towards smaller portfolios among buy-to-let landlords since the last time the CML undertook similar survey research in 2004, as the chart below shows.

Portfolio size (units) of BTL landlords, 2004 and 2016

Source: CML BTL Survey 2004 & CML Landlord Survey 2016

How old are landlords?

Just like home-owners, landlords as a group are an ageing cohort. Back in 2004, only 24% of landlords were aged 55 or over, compared with 61% today. Buy-to-let landlords are typically younger than other landlords, but only modestly so.

One reason for this is that the rate of new investors coming into the sector has slowed down. In 2004, 18% of buy-to-let landlords had bought their first property within the last two years, compared to around 7% today.

Typical landlord profile

In terms of profile, the typical landlord owns property close to their home, is just as likely to manage their property themselves as to use a managing agent, and was originally motivated to become a landlord as a contribution to their pension provision, as an investment for capital growth and income, in preference to other investments, or to supplement earnings.

Two thirds of landlords gain less than 25% of their household income from rent. Around 1 in 20 said they made a profitable full-time living from being a landlord.

Median annual gross rental income was £7,500, but the mean was £17,300 as there were some landlords with very high rental incomes. About a third of landlords earned gross rental income equating to the sum that might be associated with renting out a single property for between £416 and £830 a month.

Nearly a quarter of landlords ended up renting out property incidentally due to circumstances, while around 14% entered the market originally to provide a home for a relative or friend.

Over a third of landlords are currently offering leases longer than 12 months on at least some of their property, and most of the rest do not do so because they believe there is no demand for them.

Landlords’ plans for the future

Landlords appear to take a long-term view of their property holdings, and many landlords who entered the market decades ago remain active. There is only a modest aspiration on the part of landlords – whether buy-to-let or other – to either increase or decrease their property holdings over the next five years.

Yet the overall direction of travel in terms of sentiment and planning among current landlords appears to be a modest drift towards disposal of some of their holdings. More landlords expect to reduce their property portfolios than to increase them.

Over the next 12 months a net 6% of landlords expect to reduce their portfolios, while over the next five years a net 14% expect to do so. Buy-to-let landlords were slightly less likely to say they planned to divest at a net 5% over the next 12 months and 11% over the next five years.

Generally, the reasons given by landlords for looking to reduce their property holdings were as part of a planned exit. Only 21% of landlords overall cited any element of tax changes as part of their reason to sell. Unsurprisingly, however, among buy-to-let landlords tax featured as an element in their decision making for 36%, compared to only 13% of other landlords. Overall awareness of the various tax changes was extremely variable (see table 13 in the attached research document).

The great majority of landlords expect their net income to stay the same or increase slightly over the next five years. However, 16% of buy-to-let landlords expect to see their income fall. When asked to say what their main coping strategy would be if their cash flow position worsened, only 16% and 12% of landlords said this would be to raise rents for new and existing tenants respectively, suggesting that many landlords will look for other options before choosing to raise rents.

CML comment

Paul Smee, CML director general, comments:

“While the overall findings are encouraging and offer a reassuring picture of relative stability, there is a certain irony in the researchers’ conclusions that the landlords who will be most affected by the government’s tax changes are those at the most professional end of the sector – those with large, leveraged portfolios.

“These landlords will be particularly hard hit by the changes in the treatment of mortgage interest and may choose to divest or moderate their property holdings. Given the government’s longstanding interest in professionalising the sector, policymakers will need to be closely attuned to the risk of unintended consequences and, indeed, own goals.”